Beyond the US dollar: Financing drama during turbulent times

Read on to find out where the real money is, what genres buyers want, and how savvy producers are closing international deals.

Now, more than ever, international funding is vital to get scripted projects across the line, whether it’s to build financing through co-pros, co-commissions, pre-buys, or deficit financing against future sales.

UK broadcasters are increasingly only able to offer a limited chunk of any budget. And with platforms everywhere feeling the pinch, putting together an international finance package is anything but a breeze.

Scripted producers are raising their international game - partnering up with the right expertise and following up their contacts.

First stop, information and insight. Read on and you will find:

With US money drying up, where to find the remaining US dollars

Which other territories are financing UK-produced drama, with current numbers from Ampere Analysis.

What budget levels make sense

Which shows are in demand? Plus two mini case studies

Current advice from execs from All3Media, Sphere Abacus, Night Train Media and RTE’s head of drama.

Funding drama in a crisis

Money, money, money. Right now there isn’t enough to go round and finding a way to finance the next project is top of everyone’s list. So read on to get advice on funding routes for drama and which scripted ideas are finding their way to the top of the pile.

Not all the US money has disappeared

At Night Train Media, which works with group company distributor Eccho Rights, co-head of content James Copp talks about two US tiers: mid-to-low budget and higher end.

Before we get further in: a ready reckoner of budgets adjusted for 2025. At the top end, where £5m to £6m was a ballpark, this is now £3m to £4m; £3m to £4m is now £2.5m and £1.6m is £1m.

Finding US platforms that will buy into mid-to-low budget drama has become a narrow game.

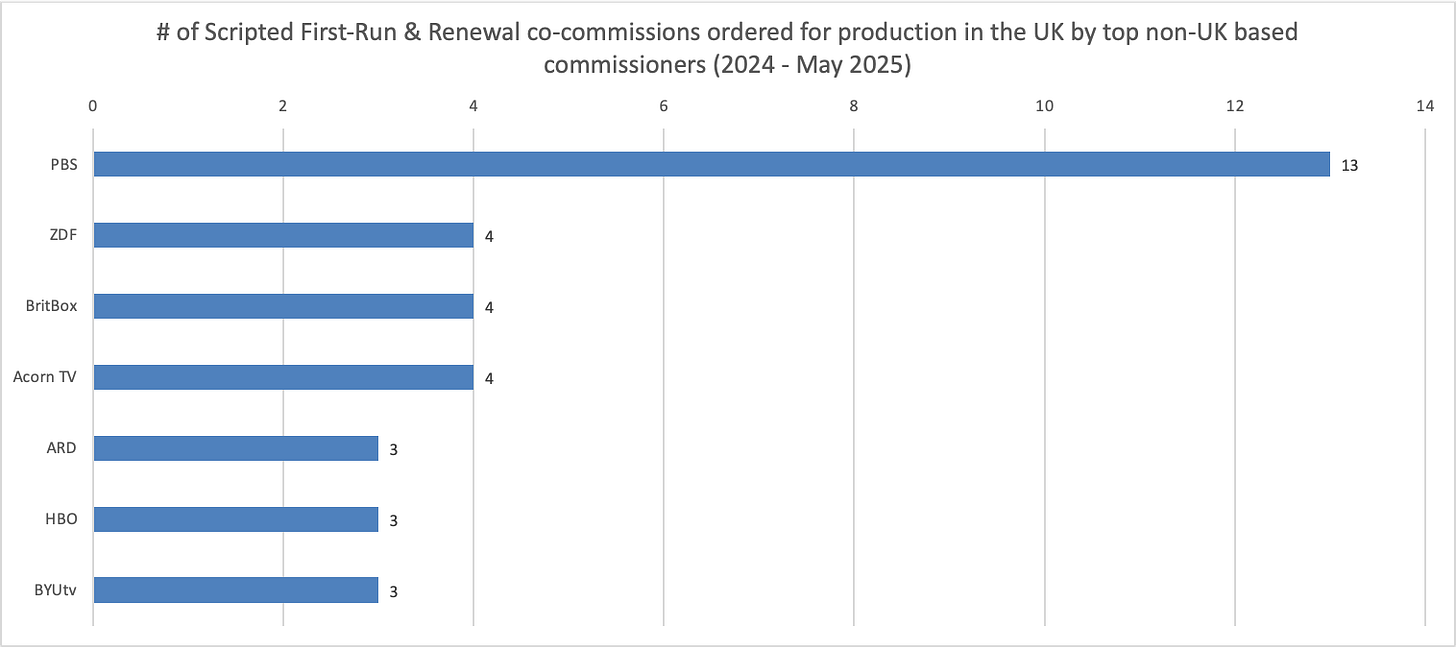

Copp identifies BritBox, Acorn and Sundance, while All3Media International EMEA EVP Stephen Driscoll names “long-standing, reliable clients like Acorn, PBS, BritBox and Hulu.”

“In the main, they’re after fewer, bigger, better,” continues Driscoll. “They are super serving their core audience and fleshing out their schedule with acquisitions.”

Disney/Hulu, FX, PBS and Masterpiece will engage at the £2m-plus per hour.

The streamers, whilst not splashing the same cash as before, still need fresh content and HBO Max launches in the UK next year, with Sasha Breslau now heading up acquisitions.

At distributor Sphere Abacus, managing director Jonathan Ford highlights US PSB funding cuts. He also points to Hulu/ Disney, AMC and Starz, as well as remaining streamer interest from Netflix and Amazon: “A lot of these players are being very careful with what they invest in, are very ratings-driven, or they are focused on home markets.”

Copp encourages producers to reach out to the US with their own contacts. “Two years ago, if you sold in the US, we would have said we’re not interested, we would want those rights.” Now, those US rights aren’t so valuable.

Takeaways: prioritise big ideas; forge your own contacts; eyes on HBO Max UK

Where in the world can we hope for funding?

It can depend on what genre. Detective procedural remains a banker for a number of European channels - by and large the public service broadcasters, says Driscoll. ZDF and ARD are up for co-producing; the BBC has a partnership with ZDF.

According to Ampere, US channels still have the highest number of UK-produced titles available on local platforms, followed closely in a top ten by Canada and then Australia.

Australia is still a steady market for UK drama, with SBS Australia and Stan being front runners. In New Zealand, TVNZ recently invested in Buccaneer Media’s In Flight, also financed by SBS in Australia, Channel 4 and Germany’s ProSiebenSat.1.

Canada comes with alluring tax breaks. Sphere Abacus is now owned by Canada’s Bell Media and Ford says, “we have been bringing ideas from the UK, which could be a potential Canadian co-production, to our sister companies.”

While Nordic platforms are open to working with UK producers, budget levels are small.

In Ireland, public service broadcaster RTÉ can help with projects that have Irish talent at their core, putting in around 20%. Head of drama David Crean has become well versed in putting together finance to make up the difference. While he wants five years rights for Ireland, the rest of the world - including the UK - is up for grabs.

“The reality of financing is that most of the time if we’re going to get a distribution advance, they need to travel,” says Crean. “We work at a budget range of between £1.6m/ £1.7m up to £2.3m per hour and we’ve found the upper end of that is hard to finance. The lower end is manageable, but still very, very difficult.”

Copp explains: “More and more people now need to look to how to finance their shows without the US and that's something we're very good at; so we’d happily join forces early on and go, ‘Look, let’s see what we can get out of these other territories’.”

Takeaways: Think of Europeans partners, possibly Irish, Australian, New Zealand and Canadian; pitch ideas that can travel

What kind of shows are flavour of the year?

Driscoll describes a cautious, risk-averse playing field with, “a lot of crime and a lot of family dramas and well-known themes. Good domestic thrillers still go down well. When it comes to young adult drama or kids, or horror, sci-fi, any niche genres that reduce the broadest audience spectrum, then that would reduce your commercial opportunities.”

He warns: “Remain careful about your run times and your number of episodes, because three-parts are difficult to place in the market, compared to a four-parter.”

Whilst European broadcasters are often unafraid of co-producing in the English language, “it needs to be British enough to sell in the UK,” warns Copp at Night Train.

He feels original ideas in the crime space can be at a disadvantage.

However Crean at RTÉ cautions. “Be very careful not to over-rely on literary IP. Something that makes a great novel will not necessarily make a great TV show.”

Apart from crime, Crean is looking for something light-hearted with a sense of humour. The Dry has been popular, as has These Sacred Vows. He’s after “something that is lighter in tone, family-based, domestic dramas that still have real punch…Something a bit White Lotus adjacent.” Nothing pre mid-90s. And he’s aiming at an audience aged 25 to 40.

Takeaways: stay mainstream with crime or family dramas; keep the strong British core; be circumspect about literary IP

Advice from the coal face

With deficit funding typically between 5-40%, distributors will often give advice at an early stage with no strings attached.

Driscoll says: “I would say to indie producers in the UK, always be very careful in terms of reference to terms of trade and ensuring you protect your second window rights, because those rights are valuable for you in your long tail of your business.”

Buyers are scared off when the budget isn’t realistic, especially if the idea is locally-rooted. “Producers, especially in smaller indies, need to be more realistic about the budgets that are actually available,” says Crean.

With casting way down the line for an original commission, for Crean, “the script is without a doubt the most important thing.”

He is also keen to emphasise how different funding sources need to, “move pretty much at the same time.” Slip into another financial year at your peril.

“Cast is king,” reckons Ford, thinking sales. “Recognisable cast gives you that better chance of getting that deal.” Ford has seen the right face create a £100K difference per episode in licence fees.

Using the regional and national screen bodies is a win all-round. “If you can take the burden per episode off by £25k or £50k, that’s absolutely worth doing. It could close your deal,” advises Copp.

Takeaways: keep your budget real; use screen bodies’ funding; protect the second window

Mini Case Studies

The Boy that Never Was started as an RTÉ commission, working with distributor Sphere Abacus. For the rest of the world outside Ireland, it went to UKTV in the UK, which put in a distribution advance. Then a pre-sale with France TV was helped by the relationship between RTÉ and France TV. Casting included Colin Morgan and Simon Callow which created competition, especially in the UK. While lead actor Colin Morgan is Irish, he’s also considered British, “so it fitted the UK audience, it fitted the Irish audience, and it fitted the audience around the world”, says Sphere Abacus’s Ford.

The Assassin, starring Keeley Hawes and produced by Two Brothers was commissioned by Amazon for just the UK. Two Brothers talked with All3Media International at an early stage and brought on ZDF as co-producer with Stan Australia, plus All3 deficit funding. “Even a strong producer like that still needs a lot of help in terms of putting together the funding model in today’s market,” says All3’s Driscoll.

If you would like a specific topic covered or are interested in collaborating with us, please email: hello@theindiehustle.com

Finally, follow us on our new LinkedIn channel to stay up to date with the latest from The Indie Hustle. Thanks for reading!